The Road Scholars travel team attended the recent auctions at Amelia Island. We heard a lot of chatter about what the results mean for the collector car market. There were more than a few doomsayers who cited the number of ‘no sales’ and cars selling below their low estimates as signs of a declining market. Some people blamed the approaching tax season, and I’m guessing the sun got in a few folks’ eyes.

Here’s our take.

The sky isn’t falling.

Auctions can be a great place to buy a car and they can be a great place to sell a car. But the results of any auction that most people look at – throughput and total sales – are not necessarily a good indicator of the health of the overall market.

Let’s look at why auction results in general aren’t a bellwether of the market. Then we’ll look at a few measures that indicate that the Porsche collector car market is, indeed, healthy.

Auctions in General

First, a single auction is really dozens of consecutive individual sales. What a 1952 Lancia Aurelia B52 Coupe sells for has little bearing on what the next-up 1955 Porsche 356 1500 Speedster sells for. A single auction is also an incredibly small but very public sample of all sales. The vast majority of sales are not publicly disclosed. Imagine if the New York Stock Exchange was only open three days a year, yet private sales of stock occurred every day. It would be very difficult to value a particular stock on a particular day with only three days’ public information.

Second, what’s in the room plays a big role in the ‘success’ of an auction. Cars that are less rare or in average condition will always sell for less than rare cars in excellent condition. The results of an auction are largely determined by what the house offers, not by the overall market.

Third, who’s in the room has a great influence on an auction’s outcome. Consider two groups of buyers: personal and professional. The personal buyer tends to have a more emotional interest in a vehicle and likely has less information about that car or the market than the professional. The professional buyer, whether a reseller or a buyer’s agent, is generally more disciplined and better informed via a thorough vetting of the car’s documentation and an experienced pre-purchase inspector.

Both buyers are constrained by what they could pay, independent of the market for a car. Either buyer might have a self-imposed spending limit or be limited by their bank letter. The reseller needs to allow for his own profit margin and therefore must stop bidding before reaching a retail market value for the car. So, it doesn’t matter what they would pay. The buyers are limited to what they could pay.

It follows that no one except the winning bidder knows what he would pay for the car. The winner needs only to exceed what the second-highest bidder would pay. So, while auctions are very efficient at selling cars at the second-highest valuation, they do not always maximize the amount realized.

What Amelia Island Told Us

We can draw some conclusions from the specific outcomes of the Amelia Island auctions. First, many people are overly concerned about the pre-sale estimates. Second, there are two lesser-known market indicators that tell us the Porsche collector car market is in better shape than many people think.

What are Estimates and Why Do We Care?

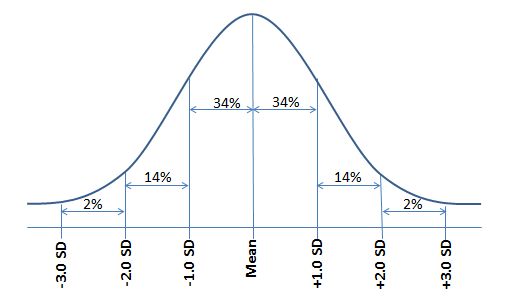

“The estimates were too high” is a common theme we heard in Amelia Island and have read in the post-mortems. The inference is that buyers sat on their hands because the prices they were expected to pay were too high. But the estimates are just a reflection of the bell curve of expected prices. (The bell curve explains a lot of things in life, but that’s for another day.)

A quick layman’s review for those who slept through statistics class: A standard distribution starts with an average, or mean, of several data points. How far away from the mean a particular data point lies is expressed as the standard deviation (SD). As the figure below shows, 34% of the data points will fall within one standard deviation of the mean and 34% will be one above. 95% will be within plus or minus two SD.

Think of the low estimate as -1 SD and the high estimate as +1 SD. The house thinks that two thirds of all similar cars have sold or will sell in this range. Think of the reserve as being somewhere in the -2 SD range.

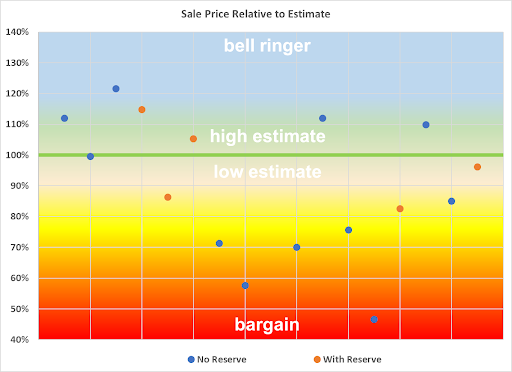

The chart below shows the results of non-race, non-outlaw Porsches sold at the RM Sotheby’s auction. The sale price is expressed by what percentage it either exceeded or fell below the mean estimate.

The majority of sales fell within 20% of the mean estimate. About half sold above the mean estimate and one third sold above the high estimate. Overall, it looks like these estimates were reasonable.

How Strong is the Porsche Market?

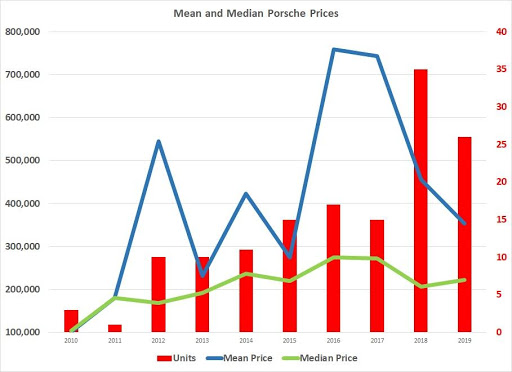

Average transaction price and median transaction price are two traditional market indicators. The average transaction price is not as useful with a small number of transactions. One high-dollar outlier can skew the mean. (See Gooding AI results from 2016: a $5.3 million 550 Spyder busted the curve for the 16 other Porsches.)

Median transaction price (again, for those sleeping through class, half the sales are above the median and half are below) can be a good indicator of the state of the market, especially over time.

Let’s look at the results of Porsches sold at Amelia Island through the Gooding & Company auctions over the last 10 years.

The chart below shows for each year the number of Porsches sold, the mean transaction price, and the median transaction price.

Porsche cars were just a footnote in 2010 and 2011. Units sold and prices realized have trended upward ever since. The median price crossed $200,000 in 2014 and has stayed above that since. In 2019, 26 Porsches crossed the block, and half sold for more the $220,000. Hardly the sign of a weak market.

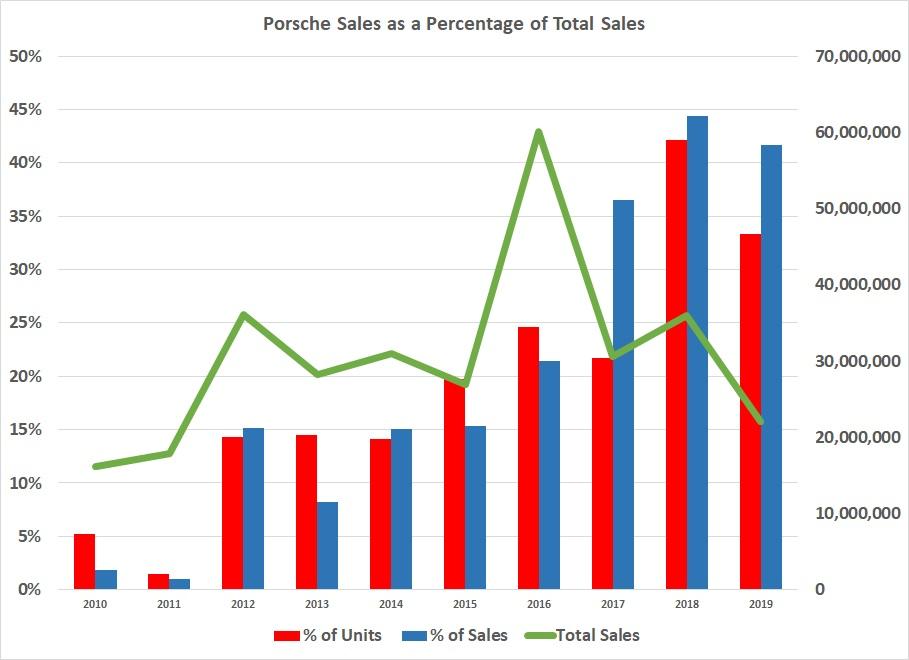

And last, here’s one more measure from the previous ten Gooding sales. This chart shows how many Porsches have sold and their median prices relative to the sales of all cars at the auctions.

The Porsche contribution has gone from negligible to quite significant – more than 40% of the revenue over the last two years. Again, hardly the sign of a weak market.